Use the following information to answer the question(s) below.

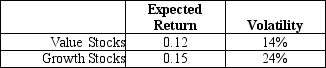

Suppose that all stocks can be grouped into two mutually exclusive portfolios (with each stock appearing in only one portfolio) : growth stocks and value stocks.Assume that these two portfolios are equal in size (market value) ,the correlation of their returns is equal to 0.6,and the portfolios have the following characteristics:  The risk-free rate is 3.5%.

The risk-free rate is 3.5%.

-The expected return on the market portfolio (which is a 50-50 combination of the value and growth portfolios) is closest to:

Definitions:

Mortgage

An agreement in which a bank or lender provides funds to a borrower at a certain interest rate, securing the loan by temporarily taking ownership of the borrower's property. This ownership is transferred back to the borrower once the loan is fully repaid.

Drawee

The party, typically a bank, on whom a check or draft is drawn and is responsible for paying the amount specified.

Checking Account

A bank account that allows for the deposit and withdrawal of funds, typically using checks, debit cards, and electronic transfers, intended for daily transactions.

Cashier's Check

A check issued by a bank or financial institution, guaranteed by the bank itself, used for making large payments where the payee requires assurance of payment.

Q18: Which of the following statements is false?<br>A)

Q22: Consider a zero-coupon bond with a $1000

Q24: Consider the following formula: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1620/.jpg" alt="Consider

Q35: Which of the following statements is false?<br>A)

Q37: Portfolio "B"<br>A) is less risky than the

Q56: Which of the following statements is false?<br>A)

Q71: The alpha for Bernard is closest to:<br>A)

Q74: Assuming that Luther's bonds receive a AAA

Q97: Using just the return data for 2008,your

Q99: What is the variance on a portfolio