Use the following information to answer the question(s) below.

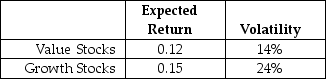

Suppose that all stocks can be grouped into two mutually exclusive portfolios (with each stock appearing in only one portfolio) : growth stocks and value stocks.Assume that these two portfolios are equal in size (market value) ,the correlation of their returns is equal to 0.6,and the portfolios have the following characteristics:  The risk free rate is 3.5%.

The risk free rate is 3.5%.

-The Sharpe ratio for the market (which is a 50-50 combination of the value and growth portfolios) portfolio is closest to:

Definitions:

Flat

Lacking in vivacity or interest; without marked variation in emotional or dynamic level.

Blunted

Lacking in force, intensity, or sharpness; often used to describe diminished emotional responses or reactions.

Exaggerated

Describes something that is represented as greater than is true or reasonable; overstated or embellished.

Establish Trust

Establishing trust involves creating a reliable, dependable, and safe environment or relationship where confidence in one another can be built.

Q8: Suppose you are a shareholder in Galt

Q11: Which of the following statements is false?<br>A)

Q23: Your estimate of the asset beta for

Q24: Assume that you have $250,000 to invest

Q38: In practice which market index is most

Q43: Which of the following statements is false?<br>A)

Q68: The standard deviation for the return on

Q70: The CAPM does not require investors have

Q80: Suppose that Taggart Transcontinental currently has no

Q81: Which of the following is not one