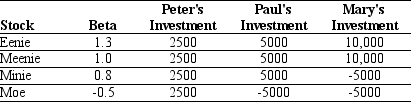

Use the table for the question(s)below.

Consider the following three individuals' portfolios consisting of investments in four stocks:

-Assuming that the risk-free rate is 4% and the expected return on the market is 12%,then calculate the required return on Mary's portfolio.

Definitions:

Opportunity Cost

The value of the next best alternative foregone as a result of making a decision.

Special Order

A customer request for a product or service that is not generally available or outside the business’s normal operations, often requiring special pricing or production considerations.

Capacity

The maximum level of output that a company can sustain to make a product or provide a service under normal conditions.

Activity-Based System

A method in accounting that allocates costs to specific activities based on their use of resources, aimed at providing more accurate cost information.

Q21: Von Bora Corporation (VBC)is expected to pay

Q23: Suppose that KAN's beta is 1.5.If the

Q26: You are considering adding a microbrewery on

Q47: If the risk-free rate is 3% and

Q56: Suppose a ten-year bond with semiannual coupons

Q70: Assuming that Novartis AG (NVS)has an EPS

Q71: With its current leverage,WELS Corporation will have

Q87: Which of the following statements is false?<br>A)

Q97: Using just the return data for 2008,your

Q105: Assume that in the event of default,20%