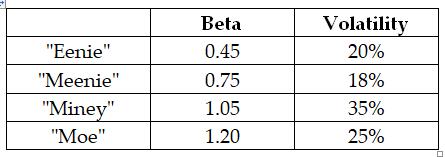

Use the following information to answer the question(s) below

Assume that the risk-free rate of interest is 3% and you estimate the market's expected return to be 9%.

-Which firm has the most total risk?

Definitions:

Initialized

Refers to the process of assigning an initial value to a variable at the time of its declaration.

Properly Declared

Refers to variables or objects in programming that have been correctly initialized or defined according to the language's syntax rules.

Console.nextInt()

A method in Java that reads the next integer from the console input provided by the user.

EOF-controlled

EOF-controlled loops continue to execute until the End of File (EOF) is reached, typically used in file reading operations to process each element until the file ends.

Q6: NoGrowth industries presently pays an annual dividend

Q25: Trucks R' Us has a market capitalization

Q32: The expected return on security with a

Q39: The price today of a 4 year

Q65: Rearden Metals expects to have earnings this

Q67: Consider a bond that pays annually an

Q76: The incremental cash flow that Galt Motors

Q79: If you want to value a firm

Q80: Assume that in the event of default,20%

Q86: Which of the following statements is false?<br>A)