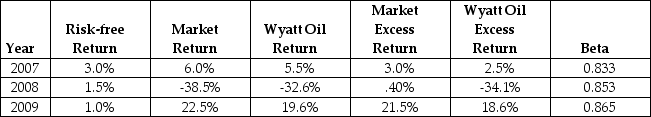

Use the following information to answer the question(s) below.

-Using the average historical excess returns for both Wyatt Oil and the Market portfolio estimate of Wyatt Oil's Beta.When using this beta,the alpha for Wyatt oil in 2007 is closest to:

Definitions:

Direct Materials

Raw materials that are directly traceable to the manufacturing of a specific product.

Actual Hours

The real number of hours worked, as opposed to planned or scheduled hours.

Standard Cost System

An accounting method that uses cost estimates for materials, labor, and overhead to control business costs.

Variable Overhead Spending Variance

The difference between the actual variable overhead incurred and the expected (or standard) variable overhead based on the actual level of production activity.

Q24: The market capitalization of d'Anconia Copper before

Q25: Which of the following statements is false?<br>A)

Q37: Nielson's EPS if they change their capital

Q38: In practice which market index is most

Q48: Rearden's expected dividend yield is closest to:<br>A)

Q49: According to MM Proposition 1,the stock price

Q71: Which of the following equations is incorrect?<br>A)

Q77: The Grant Corporation is considering permanently adding

Q82: Assuming that Defenestration's dividend payout rate and

Q95: Assuming that Novartis AG (NVS)has an EPS