Use the following information to answer the question(s) below.

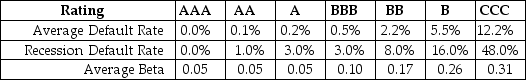

Consider the following information regarding corporate bonds:

-Nielson Motors plans to issue 10-year bonds that it believes will have an BBB rating.Suppose AAA bonds with the same maturity have a 3.5% yield.Assume that the market risk premium is 5% and the expected loss rate in the event of default on the bonds is 60%.The yield that these bonds will have to pay during average economic times is closest to:

Definitions:

Downward Systems

Communication channels that convey information and directives from higher levels of an organization to its lower levels.

Employee Rights

Legal or moral entitlements pertaining to individuals' workplace conditions, safety, and treatment.

Employee Relations

The management of relationships between employers and employees, focusing on minimizing conflicts and fostering a positive, productive workplace environment.

Organizational Standards

Established norms and criteria within an organization that guide the quality and performance of its processes, products, or services.

Q5: Portfolio "A"<br>A) has a relatively lower expected

Q10: Which of the following equations is incorrect?<br>A)

Q41: Which of the following statements is false?<br>A)

Q50: A(n)_ is the most common way that

Q52: What do you anticipate will happen to

Q64: Consider the following equation: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1620/.jpg" alt="Consider

Q71: Wyatt Oil has a bond issue outstanding

Q77: Suppose that you want to use the

Q91: The Rufus Corporation has 125 million shares

Q117: Which of the following statements is false?<br>A)