Use the following information to answer the question(s) below.

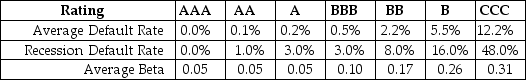

Consider the following information regarding corporate bonds:

-Nielson Motors plans to issue 10-year bonds that it believes will have an BBB rating.Suppose AAA bonds with the same maturity have a 3.5% yield.Assume that the market risk premium is 5% and the expected loss rate in the event of default on the bonds is 60%.The yield that these bonds will have to pay during a recession is closest to:

Definitions:

Cistercian Churches

Churches built in the style associated with the Cistercian Order, characterized by simplicity, austerity, and a focus on light.

Sculptural Decoration

An embellishment or adornment of a building or object with sculpture, adding artistic elements and details through three-dimensional forms.

Notre-Dame At Fontenay

Refers to the Cistercian Abbey of Notre-Dame at Fontenay in Burgundy, France, a prime example of Romanesque monastic architecture from the 12th century.

Insurance

A financial product or agreement where an individual or entity receives financial protection or reimbursement against losses from an insurance company.

Q4: Assume that you are an investor with

Q19: Assuming that this bond trades for $1,035.44,then

Q21: Which of the following statements is false?<br>A)

Q22: Which of the following equations is incorrect?<br>A)

Q25: Trucks R' Us has a market capitalization

Q27: Which of the following statements is false?<br>A)

Q30: Which of the following statements is false?<br>A)

Q40: An analysis that breaks the NPV calculation

Q51: What is the excess return for the

Q76: Assume that Omicron uses the entire $50