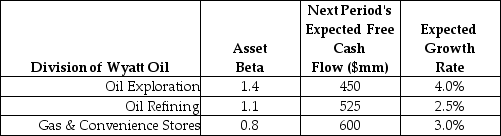

Use the following information to answer the question(s) below.  The risk-free rate of interest is 3% and the market risk premium is 5%.

The risk-free rate of interest is 3% and the market risk premium is 5%.

-The overall asset beta for Wyatt Oil is closest to:

Definitions:

Suppressed Behavior

Actions or reactions that are deliberately held back, restrained, or controlled.

Antagonistic

Refers to forces, muscles, or substances in opposition to each other, resulting in conflict or inhibition of action.

Extinction of Avoidance

The process through which an avoidance behavior is reduced or eliminated, typically by removing the negative reinforcement that maintained the behavior.

Q20: Using the FFC four factor model and

Q20: Nielson Motors has a share price of

Q55: Which of the following stocks represent selling

Q59: Rearden Metal has a bond issue outstanding

Q68: Which of the following statements is false?<br>A)

Q81: Which of the following statements is false?<br>A)

Q81: What are some common multiples used to

Q89: The Sisyphean Company's common stock is currently

Q91: Suppose the risk-free interest rate is 4%.If

Q132: Calculate the covariance between Stock Y's and