Use the following information to answer the question(s) below.

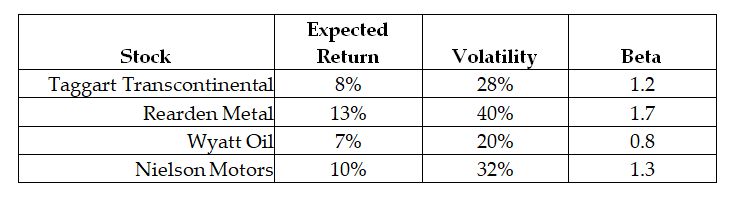

Assume that the CAPM is a good description of stock price returns. The market expected return is 8% with 12% volatility and the risk-free rate is 3%. New information arrives that does not change any of these numbers, but it does change the expected returns of the following stocks:

-The expected alpha for Taggart Transcontinental is closest to:

Definitions:

Nature

The collective occurrences of the material universe, encompassing flora, fauna, terrains, and other natural aspects and outputs of the planet, in contrast to human beings or their inventions.

Cycladic Figurines

Small, ancient sculptures from the Cycladic islands of the Aegean Sea, characterized by their abstract, geometric forms and dating from the Early Bronze Age.

Textile Garments

Clothing and attire made from woven or knitted materials.

Paint

A pigmented liquid or paste used to color, protect, or provide texture to surfaces.

Q7: Which of the following statements is false?<br>A)

Q10: Consider a corporate bond with a $1000

Q14: Iota's weighted average cost of capital is

Q20: Nielson Motors has a share price of

Q39: Which of the following statements is false?<br>A)

Q41: The number of new shares that Kinston

Q43: Which of the following statements is false?<br>A)

Q56: Which of the following statements is false?<br>A)

Q56: Which of the following statements is false?<br>A)

Q92: Which of the following statements is false?<br>A)