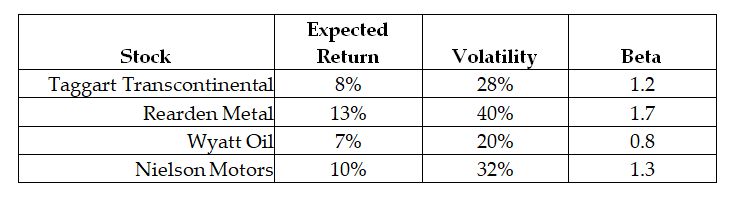

Use the following information to answer the question(s) below.

Assume that the CAPM is a good description of stock price returns. The market expected return is 8% with 12% volatility and the risk-free rate is 3%. New information arrives that does not change any of these numbers, but it does change the expected returns of the following stocks:

-The expected alpha for Wyatt Oil is closest to:

Definitions:

Q7: The expected return on the precious metals

Q21: Net of ordinary income taxes,the amount that

Q29: Portfolio "C"<br>A) is less risky than the

Q35: Because debtor-in-possession (DIP)financing is senior to all

Q45: Including its cash,Omicron's total market value is

Q48: Rearden's expected dividend yield is closest to:<br>A)

Q73: Which of the following statements is false?<br>A)

Q82: Suppose that Rearden Metal currently has no

Q104: The weight on Ball Corporation in your

Q119: The weight on Abbott Labs in your