Use the following information to answer the question(s) below.

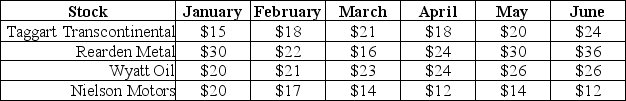

Consider the price paths of the following stocks over a six-month period:

None of these stocks pay dividends.

None of these stocks pay dividends.

-Assume that you are an investor with the disposition effect and you bought each of these stocks in January.Suppose that it is currently the end of June,which stocks are you most inclined to sell?

1) Taggart Transcontinental

2) Rearden Metal

3) Wyatt Oil

4) Nielson Motors

Definitions:

Portfolio's Beta

A measure of a portfolio's sensitivity to market movements, indicating how much the portfolio's value is expected to change with a change in the overall market.

S&P500 Value

Refers to the total market value of all stocks listed in the Standard & Poor's 500 Index, a commonly used representation of the U.S. equity market.

Futures Position

A commitment to buy or sell a specified amount of a commodity or financial instrument at a predetermined price at a specified time in the future.

FTSE 100 Futures

Financial contracts to buy or sell the FTSE 100 stock index at a predetermined future date and price, used for hedging or speculation on the direction of the UK stock market.

Q4: Which of the following statements is false?<br>A)

Q4: Assume that in the event of default,20%

Q8: Consider the following equation: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1620/.jpg" alt="Consider

Q36: Taggart's stock price is closest to:<br>A) $12.50<br>B)

Q47: Omicron's weighted average cost of capital is

Q47: In a world with taxes,which of the

Q69: Assuming your cost of capital is 6

Q91: The Rufus Corporation has 125 million shares

Q92: Which of the following statements is false?<br>A)

Q95: Galt Industries has a market capitalization of