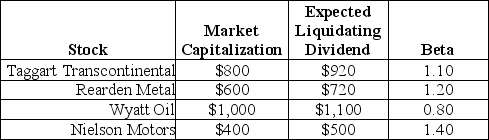

Use the following information to answer the question(s) below.

All amounts are in millions.

All amounts are in millions.

-If the risk-free rate is 3% and the market risk premium is 5%,then the CAPM's predicted expected return for Wyatt Oil is closest to:

Definitions:

Factory Overhead

The indirect costs involved in manufacturing beyond direct materials and labor costs, including expenses like equipment maintenance, utilities, and factory management salaries.

Machine Hours

Machine hours refer to the total time that a piece of machinery or equipment is operated within a specific period, often used as a basis for allocating manufacturing overhead costs.

Perpetual System

An inventory management system that continuously updates inventory records, reflecting purchases and sales in real-time.

First-In, First-Out

An inventory valuation method that assumes that the first items placed in inventory are the first items sold, ideal for products that are perishable or have a short shelf life.

Q12: The market value of Luther's non-cash assets

Q16: Which of the following statements is false?<br>A)

Q22: Consider the following equation:<br>E + D =

Q25: Which of the following is consistent with

Q30: The standard deviation of the returns on

Q41: The expected return for the fad follower's

Q57: Luther Industries has a market capitalization of

Q66: Assuming that Luther's bonds receive a AAA

Q95: The NPV for this project is closest

Q98: Assume that you purchased General Electric Company