Use the information for the question(s) below.

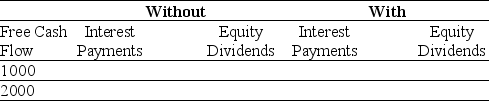

Consider two firms: firm Without has no debt, and firm With has debt of $10,000 on which it pays interest of 5% per year. Both companies have identical projects that generate free cash flows of $1000 or $2000 each year. Suppose that there are no taxes, and after paying any interest on debt, both companies use all remaining cash free cash flows to pay dividends each year.

-Fill in the table below showing the payments debt and equity holders of each firm will receive given each of the two possible levels of free cash flows:

Definitions:

Debt Instrument

A paper or electronic obligation that enables the issuing party to raise funds by promising to repay a lender in accordance with terms of a contract.

Bond

A fixed income investment in which an investor loans money to an entity (corporate or governmental) which borrows the funds for a defined period at a variable or fixed interest rate.

Financial Asset

An intangible asset that derives value from a contractual right or ownership claim, such as stocks, bonds, or bank deposits.

Company's Profits

The financial gain realized when the revenues generated from business activities exceed the expenses, costs, and taxes needed to sustain the activities.

Q5: Which of the following statements is false?<br>A)

Q8: The after tax interest expense in 2010

Q10: One factor that can affect the market

Q15: Which of the following types of risk

Q17: Which of the following equations is incorrect?<br>A)

Q40: The total amount available to payout to

Q43: The beta for Wyatt Oil is closest

Q43: The weighted average cost of capital for

Q72: Assume that Omicron uses the entire $50

Q93: Consider a portfolio that consists of an