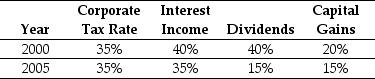

Use the table for the question(s) below.

Consider the following historical top federal tax rates in the United States:

Personal Tax Rates

-In 2005,assuming an average dividend payout ratio of 50%,the effective tax advantage for debt (τ*) was closest to:

Definitions:

Largest Organisation

The biggest or most extensive entity in terms of structure, scope, or membership within a specific context or sector.

Introspection

The examination of one's own conscious thoughts and feelings, often used as a method in psychological studies.

Soft Drink

A non-alcoholic, flavored, and often carbonated beverage.

Empiricism

The theory that knowledge arises from sensory experience, emphasizing observation and experimentation in the accumulation of knowledge.

Q5: Assume the NPV of a project is

Q19: Suppose that to raise the funds for

Q21: Assuming that to fund the investment Taggart

Q26: Rose Industries has a $20 million loan

Q30: The NPV for Iota's new project is

Q57: Wyatt Oil has 25 million shares outstanding

Q79: Anyone who purchases the stock on or

Q82: The firm's unlevered (asset)beta is<br>A) the weighted

Q86: If you take the job with Wyatt

Q109: Suppose that the managers at Rearden Metal