Use the information for the question(s) below.

KD Industries has 30 million shares outstanding with a market price of $20 per share and no debt. KD has had consistently stable earnings, and pays a 35% tax rate. Management plans to borrow $200 million on a permanent basis through a leveraged recapitalization in which they would use the borrowed funds to repurchase outstanding shares.

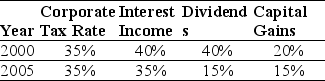

-Assume the following tax schedule:

Personal Tax Rates

Considering the effect of personal taxes,calculate the PV of the interest tax shield provided by KD's recapitalization in 2005.

Definitions:

Jean Piaget

A psychologist from Switzerland renowned for his groundbreaking contributions to the study of child development, especially his cognitive development theory.

Paul Ekman

A psychologist renowned for his research on the classification of human emotions and their expression through facial expressions.

Median

The middle value in a data set, which divides the set into two equal halves.

Mode

describes the value that appears most frequently in a data set.

Q6: Which firm has the least market risk:<br>A)

Q9: A stock's alpha is defined as the

Q24: The unlevered beta for Oakley is closest

Q43: The beta for Wyatt Oil is closest

Q46: If its managers engage in empire building,then

Q46: Graph the payoff at expiration of a

Q61: Which of the following statements is false?<br>A)

Q62: What is Luther's enterprise value?<br>A) $16 billion<br>B)

Q84: Assuming that to fund the investment Taggart

Q84: Assuming its risk is the same as