Use the following information to answer the question(s) below.

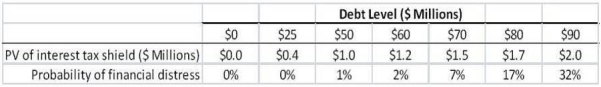

d'Anconia Copper is considering issuing one-year debt,and has come up with the following estimates of the value of the interest tax shield and the probability of distress for different levels of debt:

-If in the event of distress,the present value of distress costs is equal to $10 million,then the optimal level of debt for d'Anconia Copper is:

Definitions:

Refundable Deposit

An amount of money given as security for an item that is intended to be returned, with the promise of repayment.

Marginal Private Cost

The change in a firm's total costs that comes from making one additional unit, considering only private costs without externalities.

Abatement Cost

The cost associated with reducing or eliminating negative environmental impacts, such as pollution.

Transferable Permits

Transferable permits are regulatory instruments that allow the holder to emit a certain amount of pollution or use a certain amount of a resource; they can be bought and sold, creating a market for these permits.

Q2: The NPV of Iota's expansion project is

Q21: Net of ordinary income taxes,the amount that

Q27: Explain why the market portfolio proxy may

Q32: Which of the following statements is false?<br>A)

Q41: Consider the following equation:<br>R<sub>wacc</sub> = r<sub>U</sub> -

Q41: Which of the following statements is false?<br>A)

Q42: An option strategy in which you hold

Q46: If its managers engage in empire building,then

Q66: Wyatt Oil's excess return for 2009 is

Q73: Following the borrowing of $12 and subsequent