Use the following information to answer the question(s) below.

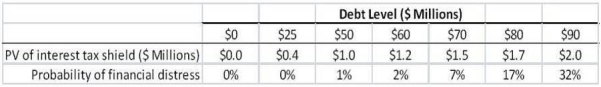

d'Anconia Copper is considering issuing one-year debt,and has come up with the following estimates of the value of the interest tax shield and the probability of distress for different levels of debt:

-If in the event of distress,the present value of distress costs is equal to $5 million,then the optimal level of debt for d'Anconia Copper is:

Definitions:

Destinations

Destinations refer to the places to which people are traveling or being sent.

Improvement Index

A metric used to quantify the gain or improvement in performance of a process or product after enhancements have been implemented.

Empty Cell

In the context of spreadsheets or databases, an empty cell refers to a cell that contains no data or value.

Source 1 - Destination 3

A model representing the transportation or transmission of resources, information, or goods from one source point to three distinct destination points.

Q19: The payoff to the holder of a

Q24: Consider the following equation:<br>D = <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1620/.jpg"

Q44: The amount of the increase in net

Q44: Which of the following statements is false?<br>A)

Q46: Which of the following statements regarding portfolio

Q47: In which years were dividends tax disadvantaged?<br>A)

Q59: Which of the following statements is false?<br>A)

Q72: The WACC for this project is closest

Q84: Which of the following statements is false?<br>A)

Q84: Assume that you have $100,000 to invest