Use the following information to answer the question(s) below.

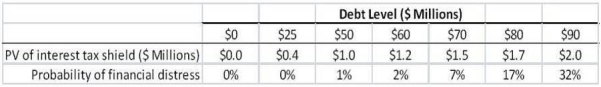

d'Anconia Copper is considering issuing one-year debt,and has come up with the following estimates of the value of the interest tax shield and the probability of distress for different levels of debt:

-If in the event of distress,the present value of distress costs is equal to $25 million,then the optimal level of debt for d'Anconia Copper is:

Definitions:

Hydrotherapy

The use of water for pain relief and treatment, which can involve various temperatures and methods.

Self-Directed

Taking initiative and responsibility for one’s own learning or actions without immediate supervision or direction.

Mobility Exercises

Exercises designed to increase the range of motion in joints and muscles, improving flexibility and reducing stiffness.

Contrast Baths

A therapeutic procedure using alternating immersions in hot and cold water to relieve pain and stimulate circulation.

Q19: Taggart Transcontinental shares are currently trading at

Q19: Assuming that the risk of the tax

Q23: The term <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1620/.jpg" alt="The term

Q36: The maximum value of a one-year American

Q37: In which years were dividends not tax

Q41: Assuming the Beta on KD stock is

Q78: Which of the following statements is false?<br>A)

Q92: Given that Rose issues new debt of

Q103: The beta for Sisyphean's new project is

Q108: The beta for the market portfolio is