Use the following information to answer the question(s) below.

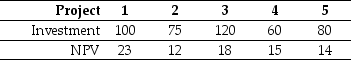

Nielson Motors has a debt-equity ratio of 1.8,an equity beta of 1.6,and a debt beta of 0.20.It is currently evaluating the following projects,none of which would change Nielson's volatility.  (All amounts are in $millions. )

(All amounts are in $millions. )

-Which of the following projects should Nielson Motors accept?

Definitions:

Neurotransmitter Reuptake

The process by which neurotransmitters are reabsorbed by the nerve cell that released them, helping to terminate the signal between neurons.

Positron-Emission Tomography (PET)

A diagnostic imaging test using a specialized dye containing radioactive tracers to visualize and measure various bodily functions.

Gamma Waves

High-frequency brain waves associated with perception, problem-solving, and consciousness.

Q19: Assume that capital markets are perfect except

Q20: Which of the following statements is false?<br>A)

Q29: Portfolio "C"<br>A) is less risky than the

Q32: If Wyatt adjusts its debt once per

Q34: The payoff to the holder of a

Q35: The unlevered cost of capital for Armadillo

Q38: If Flagstaff currently maintains a .5 debt

Q48: Consider the following equation: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1620/.jpg" alt="Consider

Q60: Suppose that BBB pays corporate taxes of

Q96: Suppose that you have invested $30,000 invested