Use the following information to answer the question(s) below.

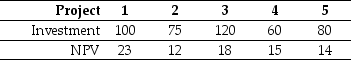

Nielson Motors has a debt-equity ratio of 1.8,an equity beta of 1.6,and a debt beta of 0.20.It is currently evaluating the following projects,none of which would change Nielson's volatility.  (All amounts are in $millions. )

(All amounts are in $millions. )

-In order for Nielson Motors to be willing to invest,project 5 must have an NPV greater than:

Definitions:

Work Sharing

An employment arrangement where two or more people share the responsibilities, hours, and benefits of a single full-time job.

Job Sharing

An employment arrangement where two or more individuals share the responsibilities, duties, and earnings of a single full-time job.

Alternative Work Arrangements

Employment setups differing from traditional full-time, on-site jobs, such as telecommuting, flexible schedules, or part-time work.

Q1: The beta for the risk free investment

Q14: Which of the following statements is false?<br>A)

Q25: Which of the following statements is false?<br>A)

Q29: Assume that you are not able to

Q31: The market portfolio<br>A) is underpriced.<br>B) has a

Q31: Assuming Luther issues a 25% stock dividend,then

Q44: Which of the following statements is false?<br>A)

Q61: Net of capital gains taxes,the amount the

Q84: Assuming its risk is the same as

Q92: Given that Rose issues new debt of