Use the information for the question(s) below.

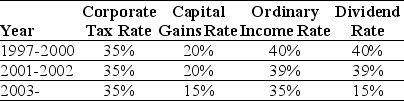

Consider the following tax rates:

*The current tax rates are set to expire in 2008 unless Congress extends them. The tax rates shown are for financial assets held for one year. For assets held less than one year, capital gains are taxed at the ordinary income tax rate (currently 35% for the highest bracket) ; the same is true for dividends if the assets are held for less than 61 days.

*The current tax rates are set to expire in 2008 unless Congress extends them. The tax rates shown are for financial assets held for one year. For assets held less than one year, capital gains are taxed at the ordinary income tax rate (currently 35% for the highest bracket) ; the same is true for dividends if the assets are held for less than 61 days.

-In 2006,Luther Incorporated paid a special dividend of $5 per share for the 100 million shares outstanding.If Luther has instead retained that cash permanently and invested it into treasury bills earning 6%,then the present value of the additional taxes paid by Luther would be closest to:

Definitions:

Prenatal Checkup

A medical examination during pregnancy aimed at monitoring the health of the mother and developing fetus, and to provide guidance on healthy pregnancy practices.

Regular Appointment

A scheduled meeting or visit, typically for a medical or professional purpose, occurring at a routine or expected time.

Weekly Schedule

A plan that outlines tasks, appointments, and activities over the course of a week.

Noon

The middle of the day, typically regarded as the moment when the sun is at its highest point in the sky.

Q7: Luther Industries is considering launching a new

Q8: The price of a one-year American put

Q24: Which of the following statements is false?<br>A)

Q27: Which of the following statements is false?<br>A)

Q38: Various trading strategies appear to offer non-zero

Q39: The e<sub>i</sub> in the regression<br>A) measures the

Q57: Assume that Omicron uses the entire $50

Q64: The overall value of Wyatt Oil (in

Q77: With perfect capital markets,what is the market

Q98: Which of the following statements is false?<br>A)