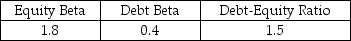

Use theUse the firm has only been listed on the stock exchange for a short time,you do not have an accurate assessment of Nielson's equity beta.However,you do have the following data for another firm in the same industry:  Nielson has a much lower debt-equity ratio of .5,which is expected to remain stable,and Nielson's debt is risk free.Nielson's corporate tax rate is 21%,the risk-free rate is 5%,and the expected return on the market portfolio is 10%.

Nielson has a much lower debt-equity ratio of .5,which is expected to remain stable,and Nielson's debt is risk free.Nielson's corporate tax rate is 21%,the risk-free rate is 5%,and the expected return on the market portfolio is 10%.

-Nielson's equity cost of capital is closest to:

Definitions:

License Plates

License Plates are metal or plastic plates attached to motor vehicles for official identification purposes, displaying a unique number or alphanumeric code issued by governmental agencies.

Moving Expenses

Costs associated with relocating from one residence to another, which may include packing, transportation, and temporary housing fees.

Speed Limits

Regulations set by authorities that specify the maximum speed at which vehicles may legally travel on a particular stretch of road.

Exponentially Depreciates

Refers to assets that lose value at a rate which accelerates over time, based on a specific formula.

Q15: Assume that to fund the investment Taggart

Q24: Which of the following is not a

Q35: If Ideko's future expected growth rate is

Q45: The term <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1620/.jpg" alt="The term

Q58: Luther Industries is considering borrowing $500 million

Q68: The alpha that investors in Galt's fund

Q72: The WACC for this project is closest

Q73: Following the borrowing of $12 and subsequent

Q95: LCMS' annual interest tax shield is closest

Q109: Suppose that the managers at Rearden Metal