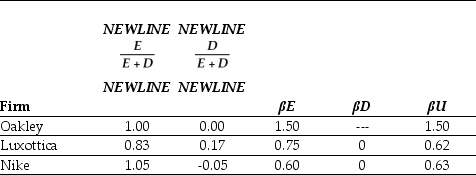

Use the table for the question(s) below.

Capital Structure and Unlevered Beta Estimates for Comparable Firms

-If the risk-free rate of interest is 6% and the market risk premium has historically averaged 5%,then the cost of capital for Luxottica is closest to:

Definitions:

Q1: Following the borrowing of $12 and subsequent

Q9: Which of the following statements is false?<br>A)

Q13: The effective tax disadvantage for retaining cash

Q15: Mutually dependent investments occur when<br>A) the value

Q20: Treasury securities that are standard coupon bonds

Q33: Taggart Transcontinental has a value of $500

Q48: Which of the following statements is false?<br>A)

Q62: Which of the following statements is false?<br>A)

Q88: Show mathematically that the stock price of

Q93: The weighted average cost of capital for