Use the table for the question(s) below.

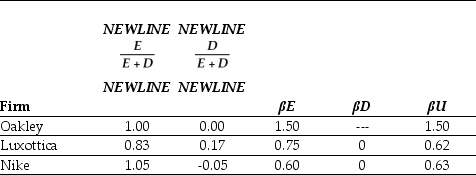

Capital Structure and Unlevered Beta Estimates for Comparable Firms

-If the risk-free rate of interest is 6% and the market risk premium has historically averaged 5%,then the cost of capital for Nike is closest to:

Definitions:

Foreclosure Rates

The percentage of properties undergoing the legal process by which a lender attempts to recover the balance of a loan from a borrower who has stopped making payments.

Prime Borrowers

Individuals who are considered low-risk by lenders due to their excellent credit history and are thus likely to receive better loan terms.

Government-sponsored Enterprises

Special financial services corporations created by the United States Congress to enhance the flow of credit to specific sectors of the economy, such as housing.

Loanable Funds

Financial resources available for borrowing, often depicted in the market where savers supply funds and borrowers demand funds.

Q1: Which of the following statements is false?<br>A)

Q2: Which of the following is not an

Q3: Consider the following equation: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1620/.jpg" alt="Consider

Q12: Which of the following statements is false?<br>A)

Q23: Assuming that Rearden's annual lease payments are

Q42: Directors who are employees,former employees,or family members

Q43: Sisyphean Bolder Movers Incorporated has no debt,a

Q44: The amount of the increase in net

Q46: The unlevered beta for Nike is closest

Q82: The effective dividend tax rate for a