Use the information for the question(s)below.

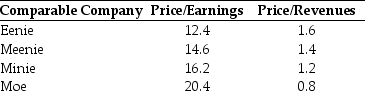

During the most recent fiscal year,KD Industries had revenues of $400 million and earnings of $30 million.KD has filed a registration statement with the SEC for its IPO.Before it is offered,KD's investment bankers would like to estimate the value of the company using comparable companies.The investment bankers have assembled the following information based on data for other companies in the same industry that have recently gone public.In each case,the ratios are based upon the IPO price.

-Based upon the price/earnings ratio,what would be a reasonable value for KD?

Definitions:

Bilaterally Symmetric

A form of symmetry where an organism can be divided into two equal halves on a single plane, showing mirror-image right and left sides.

Coelom

A fluid-filled body cavity in many animals, located between the intestinal canal and body wall, lined by tissue derived from mesoderm.

Ectoderm

The outermost layer of cells or tissue of an embryo in early development, giving rise to the nervous system and skin.

Coelom

A fluid-filled body cavity found in most multicellular animals, located between the intestinal canal and the body wall, and surrounded by mesoderm tissue.

Q2: If your firm is fully insured,the NPV

Q4: What range for the market value of

Q12: Which of the following statements is false?<br>A)

Q13: Assuming the beta on Taggart stock is

Q14: Luther Industries needs to borrow $50 million

Q28: The effective dividend tax rate for a

Q34: The amount of the increase in net

Q41: Describe the main requirements of the Sarbanes-Oxley

Q45: If Ideko's loans will have an interest

Q48: Regarding your tender offer,shareholders will<br>A) not tender