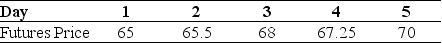

Your oil refinery will need to buy 250,000 barrels of crude oil in one week and it is worried about crude oil prices.Suppose you go long 250 crude oil futures contracts,each for 1000 barrels of crude oil,at the current futures price of $68 per barrel.Suppose futures prices change each day over the next week as follows:

What is the daily and cumulative mark to market profit or loss (in dollars)that you will have on each of the next five days?

Definitions:

Promissory Note

A written, legally binding promise to pay a specified sum of money on a certain date or upon demand.

Face Amount

The nominal or dollar value printed on a financial instrument, such as a bond or life insurance policy, representing the amount due at maturity.

Maturity Value

The amount payable to an investor at the maturity date of an investment, including the principal and any remaining interest.

Maker

The party in a financial transaction who creates or issues the instrument, such as a check writer or bond issuer.

Q4: If you are not awarded the government

Q5: Off-balance sheet transactions are required to be

Q23: The Black-Scholes value of a one-year European

Q23: Which of the following statements is false?<br>A)

Q27: This period is known for hostile,"bust-up" takeovers,in

Q39: Which of the following statements is false?<br>A)

Q43: The monthly lease payments for a four

Q54: Depreciation is _ that the firm _.<br>A)

Q54: Which of the following statements regarding municipal

Q84: When money moves forward on the timeline,the