Use the following information to answer the question(s) below.

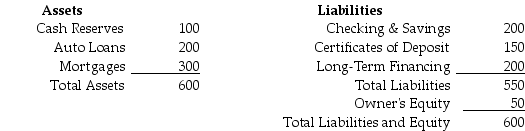

You are a risk manager for Security First Trust Savings and Loan (SFTSL) .SFTSL's balance sheet is as follows (in millions of dollars) :  The duration of the auto loans is three years and the duration of the mortgages is eight years.Both cash reserves and checking and savings have zero duration.The CDs have a duration of two years and the long-term financing has a ten-year duration.

The duration of the auto loans is three years and the duration of the mortgages is eight years.Both cash reserves and checking and savings have zero duration.The CDs have a duration of two years and the long-term financing has a ten-year duration.

-Because of a new program called Kash for Klunkers,SFTSL experiences a rash of auto loan prepayments,reducing the size of the auto loan portfolio from $200 million to $100 million and increasing the cash reserves to $200 million.After these prepayments,the duration of SFTSL's equity is closest to:

Definitions:

Prenatal Development

The progression from fertilization to delivery, involving maturation and expansion inside the uterus.

Stages

Distinct periods or phases in the development or process of something.

Postpartum Period

The phase immediately following childbirth, focusing on the mother's physical and emotional adjustment and recovery.

Family-Centered Event

Activities or occurrences designed with the primary focus of involving and benefiting all family members.

Q6: Rearden Metal has borrowed $4 million for

Q19: Which of the following statements is false?<br>A)

Q26: The IRR on the investments made by

Q27: Which of the following is not a

Q30: Which of the following statements regarding long-term

Q32: Your firm purchases goods from its supplier

Q43: The monthly lease payments for a four

Q50: Suppose a second entrepreneur approaches Joe and

Q53: Which of the following statements regarding the

Q78: Which of the four bonds is the