Use the following information to answer the question(s) below.

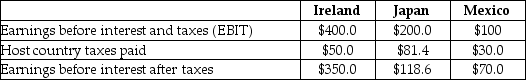

Incorporated Tool,a U.S.firm,is considering its international tax situation.The corporate tax rate in the United States is currently 21%.Incorporated Tool has major operations in Ireland,where the tax rate is 12.5%,Japan where the tax rate is 40.7%,and Mexico,where the tax rate is 30.0%.Incorporated Tool's profits,which are fully and immediately repatriated,and foreign taxes paid for the current year are as follows:

-Assuming that the Irish and Mexican subsidiaries did not exist,the U.S.tax liability on the Japanese subsidiary would be closest to:

Definitions:

Negligence

The failure to exercise the care that a reasonably prudent person would exercise in similar circumstances, leading to harm or damage.

Damages

Compensation claimed by a person who has suffered loss or harm due to the wrongful act of another.

Dry-Cleaning Chemicals

These are the chemicals used in the process of dry cleaning, which is a method of cleaning clothes and textiles using a solvent other than water.

Nominal Damages

A symbolic small amount of money awarded in court to recognize that a legal wrong has occurred, without the plaintiff having suffered significant loss.

Q23: Which of the following is not a

Q27: Directors who are not employees,former employees,or family

Q28: Accounts payable is a<br>A) long-term liability.<br>B) current

Q30: Assuming you just purchased 10,000 Bbls of

Q31: The difference between a nominal and a

Q32: Why does a firm's net income not

Q38: If the risk-free interest rate is 10%,then

Q39: Suppose you plan to hold Von Bora

Q48: You work for a pharmaceutical company that

Q76: The amount that the price of bond