Use the following information to answer the question(s) below.

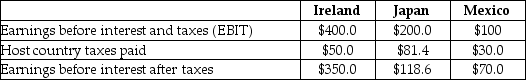

Incorporated Tool,a U.S.firm,is considering its international tax situation.The corporate tax rate in the United States is currently 21%.Incorporated Tool has major operations in Ireland,where the tax rate is 12.5%,Japan where the tax rate is 40.7%,and Mexico,where the tax rate is 30.0%.Incorporated Tool's profits,which are fully and immediately repatriated,and foreign taxes paid for the current year are as follows:

-Assuming that the Irish and Japanese subsidiaries did not exist,the U.S.tax liability on the Mexican subsidiary would be closest to:

Definitions:

Cultural Superiority

The belief that one's own culture, values, or societal norms are superior to those of other cultures, often leading to biases and misunderstanding.

Globalization

The process by which businesses or other organizations develop international influence or start operating on an international scale, impacting economics, culture, and politics.

Cross-Cultural Communication

The exchange of information and ideas between individuals or groups from different cultural backgrounds, enabling mutual understanding.

Team-Oriented Leadership

A leadership style that emphasizes collaboration, team building, and collective problem-solving to achieve group objectives.

Q3: Your firm purchases goods from its supplier

Q8: The percentage change in the price of

Q24: In general,one of the reasons that the

Q26: Which of the following statements is false?<br>A)

Q34: Assuming you currently have 10,000 Bbls of

Q38: The Bank of Canada determines very short-term

Q42: Assuming that this bond trades for $1,035.44,then

Q45: Which of the following statements regarding perpetuities

Q83: Which of the following statements is false?<br>A)

Q88: Which of the following statements is false?<br>A)