Use the following information to answer the question(s) below.

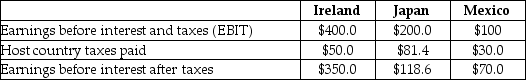

Incorporated Tool,a U.S.firm,is considering its international tax situation.The corporate tax rate in the United States is currently 21%.Incorporated Tool has major operations in Ireland,where the tax rate is 12.5%,Japan where the tax rate is 40.7%,and Mexico,where the tax rate is 30.0%.Incorporated Tool's profits,which are fully and immediately repatriated,and foreign taxes paid for the current year are as follows:

-Incorporated Tools' total U.S.tax liability on its foreign earnings is closest to:

Definitions:

Postponement

A strategy in supply chain management involving delaying product customization or distribution until customer orders are received to reduce inventory costs.

Demand Variability

Fluctuations in customer demand over a period, impacting inventory levels and production planning.

Lead Time Variability

The inconsistency or fluctuation in the amount of time it takes to complete the process from order to delivery, affecting supply chain efficiency.

Cycle Service Level

A metric that measures the probability of meeting customer demand without stockouts over a standard ordering cycle, reflecting inventory efficiency and customer satisfaction.

Q3: You expect KT industries (KTI)will have earnings

Q8: The percentage change in the price of

Q20: If on December 31,2005 Luther has 8

Q30: Which of the following statements is false?<br>A)

Q33: Suppose you plan to hold Von Bora

Q40: The Black-Scholes value of a one-year,at-the-money call

Q46: Which of the following formulas is incorrect?<br>A)

Q59: The P/E ratio is not useful when

Q61: Assuming that you have made all of

Q63: Consider an ETF that is made up