Use the table for the question(s) below.

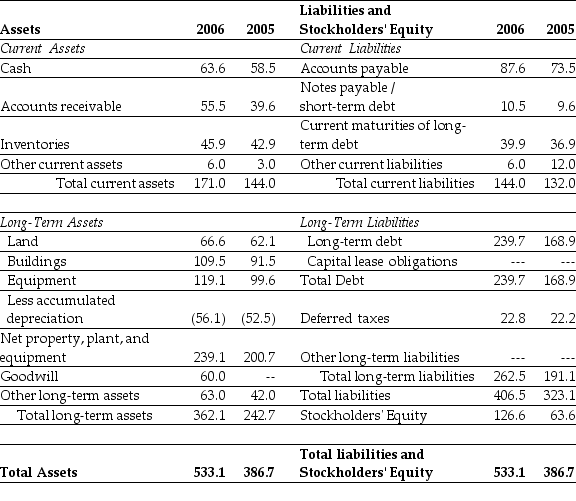

Consider the following balance sheet:

-If in 2006 Luther has 10.2 million shares outstanding and these shares are trading at $16 per share,then Luther's market-to-book ratio would be closest to:

Definitions:

Collect a Judgment

The process of legally enforcing a court's decision to recover a sum of money or other assets awarded to a party in a lawsuit.

Creditors' Meeting

A gathering of the creditors of a debtor, often during bankruptcy proceedings, to discuss the affairs, rights, and duties.

Denied a Discharge

A situation in bankruptcy proceedings where the court refuses to eliminate a debtor's liability for certain debts, thus holding them responsible for repayment.

Bankruptcy Proceeding

A legal process through which individuals or entities unable to repay debts to creditors seek relief from some or all of their debts.

Q6: Which of the following organization forms earns

Q14: In 2006,the Canadian government effectively neutralized the

Q26: If the current inflation rate is 4%

Q27: Galt Industries has issued four-month commercial paper

Q34: Which of the following statements is false?<br>A)

Q39: Which of the following statements is false?<br>A)

Q47: When the Canadian federal government issues a

Q55: Which of the following statements regarding mergers

Q57: Can the nominal interest rate ever be

Q62: Luther's price - earnings ratio (P/E)for the