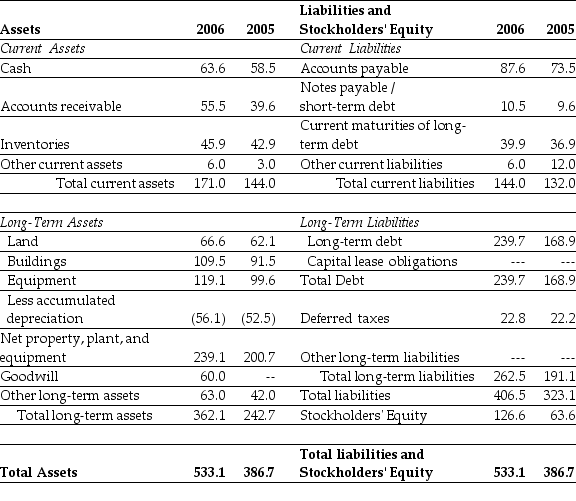

Use the table for the question(s) below.

Consider the following balance sheet:

-If in 2006 Luther has 10.2 million shares outstanding and these shares are trading at $16 per share,then using the market value of equity,the debt to equity ratio for Luther in 2006 is closest to:

Definitions:

Voltmeter

An instrument for measuring electric potential differences in volts between two points in an electric circuit.

24 VDC

A reference to a 24-volt direct current power supply, commonly used in industrial control systems and electronics.

Commissioning

The process of verifying and bringing systems, especially in building or industrial contexts, into operational status following installation to ensure they function according to design specifications.

Temporary End

An endpoint or conclusion of a process or function that is not permanent, indicating that the operation could be resumed or revisited.

Q4: Luther Industries has a dividend yield of

Q6: Luther Industries,a U.S.firm.has a subsidiary in the

Q7: What are some common multiples used to

Q12: Which of the following statements is false?<br>A)

Q27: Which of the following statements is false?<br>A)

Q62: Suppose a security with a risk-free cash

Q62: Which of the following statements is false?<br>A)

Q65: If you want to value a firm

Q65: What is the price today of a

Q94: In December 2008 in the US,Treasury Bills