Use the table for the question(s) below.

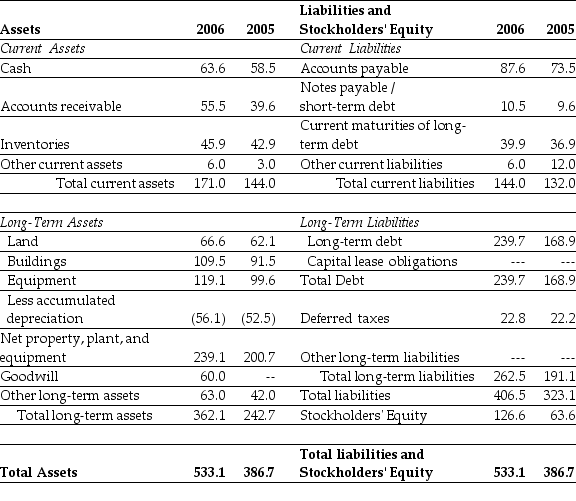

Consider the following balance sheet:

-If in 2006 Luther has 10.2 million shares outstanding and these shares are trading at $16 per share,then using the market value of equity,the debt to equity ratio for Luther in 2006 is closest to:

Definitions:

Sales Mix

The proportion of different products or services that a business sells, significant because it can affect the company's overall profitability depending on the contribution margin of each item.

Unit Contribution Margin

The difference between the selling price per unit and the variable cost per unit. This metric indicates how much each unit sold contributes to fixed costs and profit.

Cost-Volume-Profit Analysis

A management accounting method used to understand the relationship between costs, sales volume, and profit at various levels of production.

Variable Costs

Financial outlays that adjust based on the volume of production or sales, for instance, materials and workforce expenses.

Q5: If the interest rate is 10%,then which

Q7: A(n)_ invests in the equity of existing

Q12: The third party who checks annual financial

Q13: To protect the firm against the loss

Q15: Which of the following statements is false?<br>A)

Q22: The effective annual rate for Taggart if

Q23: According to the IFRS,in addition to the

Q23: Which of the following statements is false?<br>A)

Q27: Galt Industries has issued four-month commercial paper

Q58: Which of the following equations is incorrect?<br>A)