Use the information for the question(s) below.

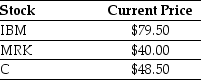

An exchange traded fund (ETF) is a security that represents a portfolio of individual stocks. Consider an ETF for which each share represents a portfolio of two shares of International Business Machines (IBM) , three shares of Merck (MRK) , and three shares of Citigroup Inc. (C) . Suppose the current market price of each individual stock are shown below:

-The price per share of the ETF in a normal market is closest to:

Definitions:

Additional Paid-In Capital

Refers to the amount of money paid by investors for shares in a company above the par value of the shares.

Par Value

The face value of a bond or stock, as stated by the issuing company, which may differ from its market value.

Stock Issuance Costs

The expenses related to issuing new stocks, including legal, accounting, and underwriting fees.

New Shares

New shares refer to additional stocks issued by a company either through public offerings or rights issues to existing shareholders, which can dilute current ownership percentages.

Q4: Which of the following statements regarding auditors

Q5: The Rufus Corporation has 125 million shares

Q13: To protect the firm against the loss

Q15: In December 2005,the spot exchange rate for

Q15: One of the major reasons that corporations

Q19: The reason given for investors not selling

Q41: Which one of the following statements is

Q54: Which of the following statements regarding arbitrage

Q56: Assume that projects A and B are

Q83: What is an opportunity cost? Should it