Use the information for the question(s) below.

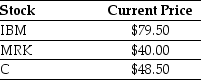

An exchange traded fund (ETF) is a security that represents a portfolio of individual stocks. Consider an ETF for which each share represents a portfolio of two shares of International Business Machines (IBM) , three shares of Merck (MRK) , and three shares of Citigroup Inc. (C) . Suppose the current market price of each individual stock are shown below:

-Suppose that the ETF is trading for $424.50; you should

Definitions:

Changing Expected Returns

The alteration in the anticipated returns on an investment due to changes in market conditions, company performance, or other factors.

Dynamic Hedging

A strategy that involves adjusting the hedge position dynamically as market conditions change, used to manage risk in trading portfolios.

Static Hedging

A financial strategy that involves setting up a position in options or other securities to mitigate risk, without needing to adjust the position frequently.

Capital Outlay

The amount of money spent on acquiring or improving fixed assets, such as buildings, equipment, and land.

Q20: How do we make adjustments when a

Q25: Which one of the following is not

Q31: The difference between a nominal and a

Q40: If in 2006 Luther has 10.2 million

Q44: The yield to maturity for the two

Q48: Plot the zero-coupon yield curve (for the

Q55: Which of the following statements regarding mergers

Q57: Assuming you currently have 10,000 Bbls of

Q59: Which of the following statements is false?<br>A)

Q70: Which of the following statements is false?<br>A)