Use the information for the question(s) below.

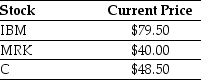

An exchange traded fund (ETF) is a security that represents a portfolio of individual stocks. Consider an ETF for which each share represents a portfolio of two shares of International Business Machines (IBM), three shares of Merck (MRK), and three shares of Citigroup Inc. (C). Suppose the current market price of each individual stock are shown below:

-Assume that the ETF is trading for $426.00.What (if any)arbitrage opportunity exists? What (if any)trades would you make?

Definitions:

Negative Reinforcement

A behavioral principle where the removal of an unpleasant stimulus strengthens a behavior or increases the likelihood of its repetition.

Unpleasant Stimulus

A negative or harmful stimulus that causes discomfort or aversion, often used in psychology to study learning, memory, and behavior conditioning.

Desired Behavior

A specific pattern of action that an individual or group aims to achieve or exhibit.

Nature

The processes within an organism that guide that organism to develop according to its genetic code.

Q3: Consider a bond that pays annually an

Q22: To insure their assets against hazards such

Q22: Which of the following statements is false?<br>A)

Q23: Monsters Inc.is a utility company that recently

Q23: Which of the following statements is false?<br>A)

Q25: Because the cash flows from owning a

Q32: Which of the following statements is false?<br>A)

Q39: Which of the following statements is false?<br>A)

Q41: Hammond's cash conversion cycle in 2009 is

Q68: Consider the following timeline detailing a stream