Use the information for the question(s) below.

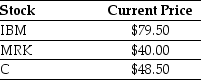

An exchange traded fund (ETF) is a security that represents a portfolio of individual stocks. Consider an ETF for which each share represents a portfolio of two shares of International Business Machines (IBM) , three shares of Merck (MRK) , and three shares of Citigroup Inc. (C) . Suppose the current market price of each individual stock are shown below:

-The price per share of the ETF in a normal market is closest to:

Definitions:

Chloroplasts

Organelles found in plant and algal cells responsible for photosynthesis, the process by which light energy is converted to chemical energy in the form of glucose.

Photosynthesis

A biochemical process in plants, algae, and some bacteria that converts sunlight, water, and carbon dioxide into glucose and oxygen, utilizing chlorophyll.

Photosynthesis Equation

Represents the chemical process by which plants, algae, and some bacteria convert light energy into chemical energy, typically summarized as 6CO2 + 6H2O + light energy -> C6H12O6 + 6O2.

Photosynthesis

A process used by plants and other organisms to convert light energy, usually from the sun, into chemical energy that can be used to fuel the organism's activities.

Q5: Which of the following statements is false?<br>A)

Q12: Savings that come from combining the marketing

Q20: Assume that you presently have a monthly

Q20: You are looking for a new truck

Q21: You are offered an investment opportunity that

Q35: Consider a corporate bond with a $1,000

Q42: In 2011,the largest stock market by value

Q47: The fact that a large company can

Q49: If Rearden offers an exchange ratio such

Q64: In WorldCom's case,the fraud was to reclassify