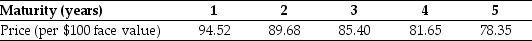

Use the table for the question(s) below.

The following table summarizes prices of various default-free zero-coupon bonds (expressed as a percentage of face value) :

-The yield to maturity for the three-year zero-coupon bond is closest to:

Definitions:

Revenue Excess

Typically refers to the situation where the revenues exceed the expenses within a given period, leading to a positive income.

Expenses Incurred

Costs that have been realized in the course of business operations, regardless of payment status.

Capital

Capital refers to financial assets or their financial value, along with the physical factors of production used to create goods and services.

Income Statement

A report documenting a business's income, costs, and earnings during a certain timeframe.

Q21: What is the dollar present value of

Q37: The Sarbanes-Oxley Act<br>A) prohibits insiders with a

Q39: If the current rate of interest is

Q41: Which one of the following statements is

Q43: Dual class shares are best defined as<br>A)

Q44: The present value of receiving $1,000 per

Q45: A 30 year mortgage loan is a<br>A)

Q58: Which of the following equations is incorrect?<br>A)

Q75: The expected return for Alpha Corporation is

Q77: Which of the following investments had the