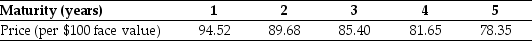

Use the table for the question(s)below.

The following table summarizes prices of various default-free zero-coupon bonds (expressed as a percentage of face value):

-Compute the yield to maturity for each of the five zero-coupon bonds.

Definitions:

Expected Profit

The forecasted or anticipated earnings from an investment or business activity, considering potential risks and returns.

Current Cost

The price that would be paid for goods or services if purchased in the current market, as opposed to historical cost.

User Cost

The cost of using a durable good or asset, which includes depreciation, interest lost on funds used to buy the asset, and maintenance costs.

Nonrenewable Resources

Natural resources that cannot be replenished within a human lifetime, such as fossil fuels or minerals.

Q2: You are in the process of purchasing

Q16: Assuming that costs continue to increase an

Q36: The Sisyphean Company is considering a new

Q61: Which of the following statements is false?<br>A)

Q62: The geometric average annual return on the

Q71: Suppose that KAN's beta is 1.5.If the

Q73: The amount that the price of bond

Q75: Which of the following statements is false?<br>A)

Q82: Assuming that Luther's bonds receive a AAA

Q104: The covariance between Lowes' and IBM's returns