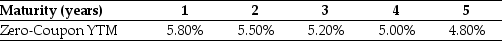

Use the table for the question(s) below.

Consider the following zero-coupon yields on default-free securities:

-The price today of a 3-year default-free security with a face value of $1000 and an annual coupon rate of 6% is closest to:

Definitions:

Social Workers

Professionals who provide assistance, advocacy, and resources to individuals, families, and communities to cope with their social, emotional, and health problems.

Assessments

Systematic procedures for measuring skills, knowledge, abilities, or attitudes for a specific purpose.

Observation

The action or process of closely monitoring or noting phenomena to gather data or draw conclusions.

Social Workers

Professionally trained individuals dedicated to assisting people in overcoming challenges and improving their well-being through various interventions and supports.

Q5: Explain the benefits of incorporation.

Q21: What is the relationship between a bond's

Q27: If the value of security "C" is

Q29: Which of the following is NOT a

Q31: Which of the following statements is correct?<br>A)

Q34: Calculate the pound denominated cost of capital

Q36: The Sisyphean Company is considering a new

Q40: The effective annual rate (EAR)for a loan

Q52: The present value (at age 30)of your

Q64: Which of the following statements is false?<br>A)