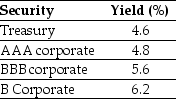

Use the table for the question(s) below.

Consider the following yields to maturity on various one-year zero-coupon securities:

-The credit spread of the B corporate bond is closest to:

Definitions:

National Defense

The government activities and measures taken to protect a country and its citizens from external and internal threats, including maintaining armed forces and developing defense strategies.

Positive

Characterized by the presence of something rather than its absence; in economics, often used to describe factual statements or analysis.

Unemployment

The situation when individuals who are capable of working are unable to find a job.

Normative

Relating to principles or rules of right conduct or the distinction between right and wrong; ethical.

Q20: Suppose you plan to hold Von Bora

Q21: The government of Canada pays lower rates

Q23: According to the IFRS,in addition to the

Q24: The investment rule with the Internal Rate

Q38: If the risk-free interest rate is 10%,then

Q41: Assuming the appropriate YTM on the Sisyphean

Q43: A hyperbola curve represents the set of

Q75: The expected return for Alpha Corporation is

Q88: What is the excess return for Corporate

Q99: Which of the following statements is false?<br>A)