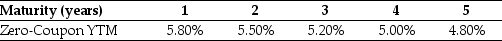

Use the table for the question(s) below.

Consider the following zero-coupon yields on default-free securities:

-The forward interest rate is a good predictor only when investors ________ about risk.

Definitions:

Opportunity Cost

The lost benefit that could have been enjoyed if the chosen option had not been taken, implying the trade-off of forgoing the next best alternative.

Efficient Production Process

A method of production that uses the least amount of resources to achieve the maximum output.

Resources And Technology

The combination of natural resources, human resources, and technology that firms use to produce goods and services.

Opportunity Cost

The cost of an alternative that must be forgone in order to pursue a certain action; the benefits you could have received by taking an alternative action.

Q8: Suppose you invest $15,000 in Merck stock

Q12: Which of the following statements is false?<br>A)

Q16: Assume that your capital is constrained,so that

Q21: The government of Canada pays lower rates

Q30: Both conservative and aggressive investors will choose

Q35: Suppose that you want to use the

Q42: In Canada,firms deduct a fraction of the

Q93: The volatility of a portfolio that is

Q94: The volatility of your investment is closest

Q97: Consider an equally weighted portfolio that contains