Use the information for the question(s) below.

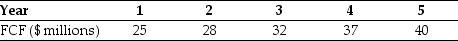

You expect CCM Corporation to generate the following free cash flows over the next five years:  Following year five,you estimate that CCM's free cash flows will grow at 5% per year and that CCM's weighted average cost of capital is 13%.

Following year five,you estimate that CCM's free cash flows will grow at 5% per year and that CCM's weighted average cost of capital is 13%.

-If CCM has $200 million of debt and 8 million shares of stock outstanding,then the share price for CCM is closest to:

Definitions:

Title Block

A section of a technical drawing or document that contains vital information such as project name, date, scale, and authorship.

Full Scale

Represents the complete, actual size or extent of an object, without any reduction or enlargement.

Scale

An instrument for measuring weight or proportionally representing the size of real-world objects in a different, usually smaller, size in drawings.

Q4: Luther's Operating Margin for the year ending

Q27: Which of the following is/are subject to

Q28: The term structure of interest rates predicts

Q33: Which stock has the highest total risk?<br>A)

Q41: Which one of the following statements is

Q43: The amount of incremental income taxes that

Q52: The incremental EBIT for Shepard Industries in

Q53: To calculate other non-cash items,a firm adds

Q63: Which of the following formulas is incorrect?<br>A)

Q78: Assume that you have $100,000 to invest