Use the table for the question(s) below.

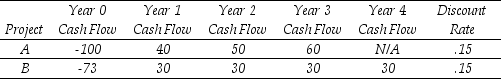

Consider the following two projects with cash flows in $:

-The payback period for project B is closest to:

Definitions:

Intrinsic Value

The actual, inherent value of a financial security, determined through fundamental analysis without reference to its market value.

Put Option

A financial contract that gives the buyer the right, but not the obligation, to sell an asset at a specified price within a specific time frame.

Actual Value

Actual value refers to the true, inherent, or market value of an asset, not influenced by external conditions such as market fluctuations or investor perceptions.

Time Value

A concept stating the value of money is affected by time, primarily due to the potential earning capacity of money over time.

Q4: The standard deviation of the returns on

Q8: Canadian mortgages are quoted with APRs using

Q13: Which of the following statements is false?<br>A)

Q18: Suppose a risky security pays an average

Q32: Which of the following statements is false?<br>A)

Q34: _ breaks the NPV calculation down into

Q42: What is the NPV of an investment

Q43: Which of the following statements is false?<br>A)

Q92: What is the beta for a type

Q102: The beta for Sisyphean's new project is