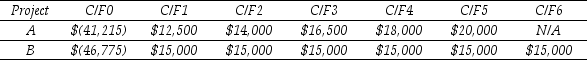

Use the table for the question(s) below.

Consider two mutually exclusive projects with the following cash flows:

-You are considering using the incremental IRR approach to decide between the two mutually exclusive projects A & B.How many potential incremental IRRs could there be?

Definitions:

Proclamation of Neutrality

A formal announcement made by the United States in 1793, declaring its neutrality in the conflict between France and Great Britain, showcasing its desire to stay out of European wars.

Trading Rights

The permissions or entitlements to conduct commercial transactions, often governed by legal agreements or international law.

U.S. Naval Power

Refers to the maritime strength and capabilities of the United States, encompassing its navy's fleet size, technology, and global reach.

War Debts

Financial obligations incurred by a country due to the costs of engaging in warfare, often involving repayments to other countries or institutions that provided loans.

Q3: You expect KT industries (KTI)will have earnings

Q17: Which of the following statements is false?<br>A)

Q20: To calculate the Capital Cost Allowance (CCA),Canadian

Q21: Which of the following statements is false?<br>A)

Q42: Calculate Luther's cash flow from operating activities

Q65: You are considering investing in a zero

Q69: The profitability index for project B is

Q82: Which of the following statements is false?<br>A)

Q88: The volatility on Home Depot's returns is

Q90: Which of the following statements is false?<br>A)