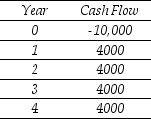

Use the table for the question(s) below.

Consider a project with the following cash flows in $:

-Assume the appropriate discount rate for this project is 15%.The profitability index for this project is closest to:

Definitions:

Removal and Restorations Costs

The expenses associated with dismantling and removing an asset, and restoring the site on which it was located.

Development Phase

A stage in the lifecycle of a project or product focused on research, design, and development activities before commercial production begins.

Volatility

A statistical measure of the dispersion of returns for a given security or market index, often used to quantify the risk of a security or portfolio.

Full Cost Method

An accounting method used in the oil and gas industry where all exploration, development, and production costs are capitalized and amortized over the life of reserves.

Q2: The geometric average annual return on IBM

Q3: The monthly discount rate that you should

Q9: The effective annual rate (EAR)for a loan

Q37: Which of the following costs would you

Q43: Which of the following formulas is incorrect?<br>A)

Q45: Which of the following statements is false?<br>A)

Q58: Suppose an investment is equally likely to

Q59: Which of the following statements is false?<br>A)

Q71: Which of the following statements is false?<br>A)

Q83: What is an opportunity cost? Should it