Use the information for the question(s) below.

Kinston Industries is considering investing in a machine that will cost $125,000 and will last for three years. The machine will generate revenues of $120,000 each year and the cost of goods sold will be 50% of sales. At the end of year three the machine will be sold for $15,000. The appropriate cost of capital is 10% and Kinston is in the 35% tax bracket.

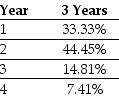

-Assume that Kinston's new machine will be depreciated using MACRS according to the following schedule:

What is the NPV of this project?

What is the NPV of this project?

Definitions:

Fictitious-Payee Rule

A principle in commercial law that a bank is not liable for fraudulent endorsement payments if the drawer intended the payee to be fictitious.

Refund

The process of returning funds to a purchaser in response to a product return, cancellation, or dissatisfaction with services provided.

Endorser

A person who signs their name on a document, often a check, to indicate their approval or to transfer ownership to another party.

Drawer

In a financial context, the person who writes or issues a check or draft instructing a bank to pay a specified sum of money to a designated party.

Q3: Unconventional cash flows normally means<br>A) that you

Q9: After your grandmother retired,she purchased an annuity

Q23: The variance on a portfolio that is

Q23: Which of the following statements is false?<br>A)

Q35: Assume that Kinston's new machine will be

Q42: In Canada,firms deduct a fraction of the

Q49: Consider the following timeline: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1623/.jpg" alt="Consider

Q49: Which of the following statements is false?<br>A)

Q56: NoGrowth Industries presently pays an annual dividend

Q68: Which of the following statements is false?<br>A)