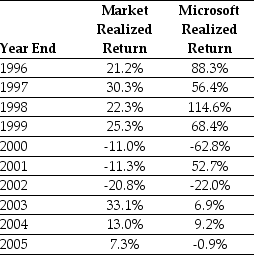

Use the table for the question(s) below.

Consider the following realized annual returns:

-Suppose that you want to use the 10 year historical average return on the Market to forecast the expected future return on the S&P 500.Calculate the 95% confidence interval for your estimate of the expect return.

Definitions:

Poverty Line

The minimum level of income deemed necessary to achieve an adequate standard of living in a given country.

Invisible Hand

A metaphor introduced by Adam Smith to describe how an individual's pursuit of self-interest in a free-market economy inadvertently benefits society as a whole.

Allocation of Resources

The process of allocating resources among competing uses or projects in order to achieve desired outcomes.

Poverty Rate

The percentage of the population whose family income falls below an absolute level called the poverty line.

Q23: The market value for Chihuahua Corporation is

Q43: Studies have shown that a market indexed

Q50: The trailing price-earning ratio is based on<br>A)

Q52: The incremental EBIT for Shepard Industries in

Q54: The effective annual rate on your firm's

Q59: Which of the following statements is false?<br>A)

Q73: Luther Industries has outstanding tax loss carryforwards

Q78: Which of the following statements is correct?<br>A)

Q90: Which of the following statements is false?<br>A)

Q104: The covariance between Lowes' and IBM's returns