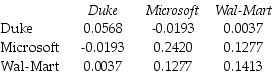

Use the table for the question(s) below.

Consider the following covariances between securities:

-The variance on a portfolio that is made up of a $6,000 investment in Duke Energy stock and a $4,000 investment in Wal-Mart stock is closest to:

Definitions:

Data Model

An abstract model that organizes elements of data and standardizes how they relate to one another and to properties of the real world entities.

Scenario Summary Report

A document or output in decision-support and planning software that shows the outcomes of different scenarios or models tested.

Power Pivot Window

A feature in Microsoft Excel that allows users to perform powerful data analysis and create sophisticated data models.

Data Model

A conceptual representation of data objects, their attributes, and relationships between them in a database.

Q2: List three kinds of real options that

Q21: The cost of capital for a project

Q27: One of the major differences between a

Q41: Assume that Kinston has the ability to

Q49: Which of the following statements is false?<br>A)

Q56: Using the data provided in the table,calculate

Q57: Suppose that Defenestration decides to pay a

Q61: Which of the following statements is false?<br>A)

Q85: The incremental unlevered net income for Shepard

Q98: Consider a zero-coupon bond with a $1,000