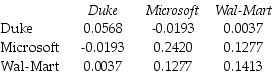

Use the table for the question(s) below.

Consider the following covariances between securities:

-The variance on a portfolio that is made up of a $6,000 investment in Duke Energy stock and a $4,000 investment in Wal-Mart stock is closest to:

Definitions:

Fixed Cost

A recurring cost that does not vary with output or sales volume, including expenses like leases and insurance that remain constant no matter the business activity level.

Value Basis

The underlying value on which something is assessed or calculated, often referring to how assets, liabilities, or equity are valued in financial statements.

Unprocessed Wheat

Wheat that has not undergone any form of processing and remains in its natural state post-harvest.

Granary

A granary is a storage facility for threshed grains or animal feed.

Q21: Which of the following statements is false?<br>A)

Q29: _ have historically earned _ returns than

Q41: Assuming the appropriate YTM on the Sisyphean

Q42: Assuming that this bond trades for $1,035.44,then

Q43: Value can be created by _ to

Q63: Which of the following statements is false?<br>A)

Q64: The total market capitalization for all four

Q66: Which of the following statements is false?<br>A)

Q91: Consider a corporate bond with a $1,000

Q91: What is the beta for a type